Student: Our population cannot grow indefinitely, can it?My last comment inspires this post. How many serial killers would it have to take before we would offset the gains by a single genius? The comments are open. My take is that it would have to be large, very large. If you were told that in the next 1 million people born there would be one genius that will make enormous contributions to the welfare of society, but also in that million people is X number of serial killers, how large would X have to be in order for you to be disappointed by this knowledge? No trick answers to this, like stating that the serial killers will kill the geniuses. You can comment that my calculus is cold, but your comment will not be interesting. Solve for x!

Me: Population growth in market societies is good for the forseeable future. It is not something that will likely ever need a planned solution to solve.

Student: Our resources are fixed though, just one planet.

Me: The only true natural resource is the human brain. Oil is a water and land ruining nuisance until a brain figures out how to turn it into energy. The more people, the more brains, the more likely we are to come up with geniuses who increase our possible resource set. We have a much larger population today than we did 100 years ago, yet we use much fewer resources to feed it.

Student: More people also mean more potential serial killers.

Me: Yes, but even a very successful serial killer is bad for 10 or 15 people, maybe 200 if you include extended family. But a genius benefits the entire population.

Saturday, May 31, 2008

How Many Serial Killers Equal One Genius?

Questions I've been pondering recently...search costs and music edition

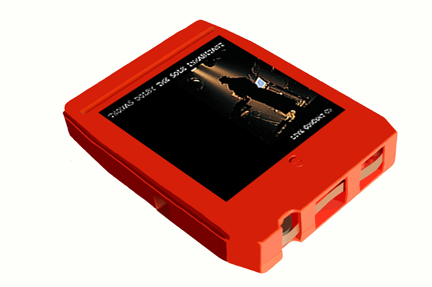

Over beers last night, we got to talking about the evolution of music delivery-- records, 8-tracks, cassette tapes, compact discs and now the digital age. Recent in my mind was a page on one-hit wonders, and I got to thinking:

Many people say that music consumers now appreciate single songs more than entire albums, and that this is a trend that didn't start recently. Could it be that the popular method of music delivery might be playing a role? On an 8-track or cassette tape, it is relatively costly to search and find a particular song; you have to wait through the time needed to fast forward or rewind to where you needed to be on the tape, and relative to the length of the song, it is definitely nontrivial. (I had a friend in elementary school whose rewind button didn't work, and when he wanted a repeat listening of "Mr. Brownstone," would have to fast forward through the remainder of Side A, flip the tape, fast forward through the entirety of Side B, flip the tape again, then fast forward to the beginning of the song-- and hope not to overshoot.) Consuming albums relative to individual songs may be the cost minimizing way to intake music.

Of course, the advent of the compact disc made the cost of finding a particular song almost zero. If people all along truly want to listen to just their favorite songs, then this shock downwards in the cost of doing so may be enough for people to stop listening to entire albums and just focus on their favorite songs. Recognizing this, bands can move away from supplying albums to supplying songs, meant to be searched directly to. Of course, the MP3 player reduces the cost even more-- with CDs, you would want a disc with a lot of good songs (remember the popularity of burning your own CDs with your favorite songs?), since changing to a different disc is relatively costly. Now, individuals effectively have one huge CD that never needs to be changed-- and search costs are still very low.

It's not that costs of selecting songs have always dropped; my experience is limited, but finding a particular track on a vinyl record is relatively less costly than on a cassette. (Which is probably why radio stations never went with tapes.) Cassettes, of course, eventually won the war due to portability.

Friday, May 30, 2008

Final Second Fouls

From stars such as LeBron James to backups like Barry, players haven't gotten last-second, game-deciding calls during the playoffs, partly because officials want the players to determine the outcome just as much as the fans do.DuPree goes on to argue that by not calling the fouls they are still changing the outcome of the game. I agree, but I think the argument should be about the incentives created by no credible threat of being called for a foul. Even King James chances of hitting the game winner decline if you hit him hard enough. Ironically, the less likely the referees are to call a foul at the end of the game, the greater influence their refereeing has on the outcome.

There are many analogies which make this a flawed style of refereeing. Suppose I catch a student cheating on their final exam in the semester prior to their graduation, should I not fail them because my enforcement of the rules change the outcome of their graduation? I think that would be absurd. Imagine if it was informally accepted that professors would not fail students who cheat on their last final exam of the semester, what would that do to the incidence of cheating? Very curious logic on the part of the NBA.

P.S. I'm not a Lakers fan.

Test time

Here's a piece on colleges moving away from the SAT.

I don't see this as being a wide-spread trend; schools still need a metric to compare students and I'd say that the SAT probably does better than most give it credit for. Note also that having these schools making the SAT arbitrary won't in an way reduce the number of students that actually take it; further, I'd imagine that reporting the score is optional and, as such, imposes an effective signaling mechanism through whether you choose to reveal your score or not. These are also small schools (though Wake Forest has over 4,000 undergrads, which is moderately sized) that likely place more emphasis on the full portfolio of a student, so the SAT didn't carry as much weight anyway. The value of the signal could well be stronger than the information from requiring the score. Large institutions still need a quicker way to judge a student and, rightly or wrongly, the SAT provides this nicely.

For what it's worth, I'd be willing to bet that of the TPS regulars, Dana or Tom Johnson top the SAT list...

Thursday, May 29, 2008

My baseball thought of the day: Rick Ankiel's throws against Colorado

I did some rough calculations based on the dimensions of Coors Field in Colorado for the second throw; conservatively, I put it at 335 feet in the air.

Absolutely incredible. This video gets the TPS Seal of Approval.

Nudge

On the plus side, there do exist a lot of scenarios where the "easy" choice gets the nod, and this is important to recognize. In general, there are categories of choices that tend to fall into the nudge-able range, like those with large intertemporal disconnects between costs and benefits and choices where feedback is low.

I think it falls a little short in a few areas; namely, that we could design a government capable of steering people in better directions. It felt a bit like the foreign aid arguments-- it's not that foreign aid is bad, it's just that we haven't done it correctly up until this point. Information issues that would prevent people from wise choices in the first place would be information issue for our utopian government as well. (The 1950s called, they want their assumptions back.) And that's independent of any public choice problems we may have; that issue gets only two pages at the back of the book.

There also was an interesting part about needing to worry about private sector nudgers at least as much as public sector ones; I'm hesitant to agree, only because I have the choice of opting out of a private sector scenario if I want. On top of that, any choices that fall into the typical nudge range from the private sector seem to have a decent amount of aggregated information to be had. I know the tradeoffs for smoking and fast food; you can't categorically say that people who smoke or eat unhealthy food and die sooner are making illogical choices any more than someone who forces himself to eat healthy food and doesn't live any longer-- or perhaps dies an early death. In the case of large scale purchases, there's a big profit incentive to provide this information. I'm not certain people are making consistently poor decisions here. Transactions costs in figuring out the "right" choice for yourself need to be factored into all of this as well.

An interesting read nonetheless.

Wednesday, May 28, 2008

Questions I've been pondering recently...school edition

I frequently drive by an elementary school here in Morgantown, as I live just down the road from one. Which got me to thinking...

If school were not compulsory at any grade level, what percentage of kids at any age would end up going?

If this were to actually happen, I think you'd see a very high rate initially, but would steadily drop off. I think elementary education would be something most would choose, though not necessarily at as young of an age. I think you'd see some decent reductions in attendance rates as the years go on as well. Once kids can watch themselves I think you'd see a drop; if you have to pay someone to watch them, why not have them in school? So, as a jumping off point: Elementary school and middle school: 90%, and high school: 60%.

Thoughts?

Singing the Recession Blues

Justin is the TPS source for all things recession, though this article got me to thinking:

- Why do people care so much if we're in a recession? People know if their own situation is more tenuous now than a year ago; does it make them feel better if others are doing badly too? Further, if it's relative measures that are so important, couldn't we just flash some pictures of sub-Saharan Africa and then everyone would feel better? The scary thing might be if people know they're in a recession, they might want the government to do something about it.

- The article is purposely inflammatory, as most articles of this ilk are, but this one seems to bother me more than most.

"...led more people to report that their personal finances have worsened than at any time since 1982, according to a recent consumer survey..."

What does that even mean? Could that be any more vague-yet-foreboding? And mind you, again, that's a relative statement, so it says nothing about the absolute state of welfare.

"They predict the unemployment rate will jump by one percentage point to 6.0% by year end."

How people could estimate this, how they could arrive at 6.0%, why we're asking them, and why this figure even matters is all beyond me. Maybe we should ask them what the unemployment rate will be in 2036? Asking a lot of people (and betting markets for that matter) works well when there's dispersed information to be aggregated; information concerning the unemployment rate in the future is not out there. (I guess the best you could do would be to survey all employers, but that's still a best guess, and certainly not what the survey did.)

"A survey from the Conference Board released Tuesday found that only 13.4% of respondents said they expect their incomes to rise in the next six months, the lowest level since the study began 41 years ago."

Note that the initial reaction is "wow, 87% of people think their income is going to fall." I'd be willing to bet "stay about the same" is a large chunk of that other 87%. Again, the sky is falling...

"Their inflation expectation has hit an all-time high."

Now this is actually interesting, as it has real macroeconomic implications. Too bad that's all they said about it. If we're going to have surveys, I would love to see a set of questions getting at this issue. To what do they attribute their high inflation expectations? Worldwide factors? The Fed? That I would like to see.

Is This Actually A Good Sign?

The 50-year-old actress suggested last week that the devastating May 12 earthquake in China could have been the result of bad karma over the government's treatment of Tibet. That prompted the founder of one of China's biggest cinema chains to say his company would not show her films in his theaters, according to a story in The Hollywood Reporter.Sharon Stone's comments were inappropriate. Did those individuals who suffered through 9/11 on the receiving end of karmic retaliation for American foreign policy? Since those individuals had nothing to do with the policy, much like those suffering in China, I would say no.

However, when I first read "China bans" I thought it was a government action, but it appears it is not, but instead the choice of the person who bears the consequences - the owner. Is this a good sign? Consider:

- A foreigner criticized the Chinese government, and a private citizen of China actually heard them.

- The government did not ban Sharon Stone movies, an individual who is under no compulsion to show her movies in the first place is declining to do so in the future.

What Do the Experts Know Anyway?

I go back to my suggestion. I think we should all take as much money out of the bank as we can, every day, and spend it on something other than gasoline. Shop at places whose owners need our money to pay their rent. Press the politicians and the banks to work out some alternative to foreclosures. And stop reading other people’s opinions.If you are willing to disregard his/her last sentence...A few points:

- Follow this advice and enjoy the poverty knowing how "smart" you are. I will not be giving you change on the street, however.

- In the media, as part of an effort to be "fair and balanced," they present an equal number of economists with differing opinions. Even if 95% of the field say "yes" and the remaining say "no," the media will give 50% of the air time to the 5% to stir the debate. It's the nature of the news business.

- This blog was tagged "Depression," which would be amusing were it not so disrespectful to those who actually had to experience the terrible Depression of the 1930's.

- The 1930's Depression had a lot to do with politicians and banks being forced to work together to "do something" by the public.

- More than one observation (Greenspan) is generally required for the "experts" to be considered wrong. Perhaps citing some economists other than Greenspan would be a start. No, economists working for special interest groups or Unions (redundant, I know) do not count.

- Forecasts longer than 1 year are mostly worthless, especially at the national level. We usually do not know what has happened with much precision over the current year because the data is still being collected. Our ability to forecast the future has an error at least as large as the error in our understanding of what is happening now.

- Note that this forecast error is better than weather forecasts, so we got that going for us.

Tuesday, May 27, 2008

Housing Market Blues and Wha-Hoos!

Radiohead

I was under the impression that I had posted previously about their pay-what-you-feel album release, but I don't see it in the archives. It was actually a great vehicle by which to address a lot of issues in my Public Economics section last fall. Public goods, strategic thinking both by the band and the consumer, it really covered it all. For the record, I gave five pounds.

For the record, Radiohead is the most (only?) consistently popular-while-experimenting band of my lifetime, and probably the most since Pink Floyd. I personally am not a huge fan of Pablo Honey, and the Bends really hasn't grown on me either, though I would attribute that at least partially to not getting into Radiohead until around 1997. Ok Computer, Amnesiac and Hail to the Thief are all absolutely stunning works, and will continue to be for a long while.

File this under.....demand curves slope downwards

Montreal

I'm back from Montreal with a few comments.

- The Great Cash Free Challenge, International Edition, ended on Saturday at 2:15pm EST, that was 98.25 hours beyond the starting time, so the over paid. (Though barely, Rob Holub can price a bet.) There were a couple of circumstances that combined to end the scenario-- the nearby subway station was not large enough so as to sell day-long passes (and therefore having an attendee to accept a credit card), and the automatic ticket seller was non-functional. Thus, cash for subway tickets.

- I was told that Montreal would sporadically accept credit cards; either I went to the right places or that was false.

- Cabs accepted credit cards, no problem there. I suppose I could have cabbed myself around Montreal on credit cards, but that realization came after throwing down some cash for subway tickets.

- I've been told Montreal is an expensive town; I wouldn't disagree, though seemingly expensive meals do include a goodly portion of food (soup, salad and dessert were all included every place I ate) and good deals can be found with a bit of hunting. Mussels were great, as was the calamari.

- Montreal strikes me a currently clean, yet aging, town that will seem run down in about 20 years. The subway is functional and awfully frequent (thank you government over-provision) but, again, will seem outdated in the near future.

I'll still be keeping cash-free here in the U.S. for as long as possible to complete the spirit of the challenge. I can see the upcoming Pearl Jam concert as being slightly trying...otherwise, Great Wall and Jimmy John's accept credit cards, onwards and upwards.

Monday, May 26, 2008

Non-Taxation Non-Profit

This sounds counterintuitive, but there are many industries in which the tax exempt status prevents NPOs from emerging and competing rather than encouraging it. The solution is then to end taxation of firms, so as to end the need maintain NPO tax status. There is no such thing as taxing a firm anyway, only households.

Sunday, May 25, 2008

Frankly Pigouvian

THAT the invisible hand often breaks down is actually good news. After all, we need to tax something to pay for public services. By taxing forms of consumption that generate negative side effects, we could not only generate enough revenue to eliminate budget deficits, but also help steer resources toward their most highly valued uses.I found much in this article to draw argument with, but I'm going to focus on this statement alone. The idea that, "fortunately" we may have a

This is an article sure to be critiqued heavily by classical liberals in the coming days over the blogosphere, this is my contribution.

Saturday, May 24, 2008

If I May Defend Dr. Jones

that the Soviet Union in 1957 "did not send terrorists to the States," but launched a satellite, "which evoked the admiration of the whole world."If I may add, the Soviet Union also starved its own people, persecuted dozens of groups like minority races, ethnicities, earth scientists, and religious denominations. In order to put that satellite in space, the most powerful totalitarian regime that has ever stalked the earth devoted countless resources away from more functional uses that could have improved the standard of living of millions and prevented many of their unnecessary deaths. All to boost the ego of those few with power in Moscow. The absence of trust, reputation, and charity that flourishes and grows in Capitalist society has left a cultural deficit in Russia that continues to plague their society even to this day.

That is the legacy of the Soviet Union. Banning Indiana Jones won't change that.

Selling Out From Journalism to Publishing

I assured her that despite a great disparity in supply, I have read many great books, but have read few, if any, great newspaper articles.

Friday, May 23, 2008

Buildings: Government Provided

In reading about the country's first interest group, the Grand Army of the Republic (basically Northern Civil War veterans), I came across a fantastic description of the Pension Building in Washington, D.C., which came as a result of the G.A.R. lobbying for, and eventually getting, pensions for Civil War vets.

"The Pension Building was, and remains, 15.5 million bricks in search of an identity, and arguably, such a Tutankhamenesque creation could have been built only in nineteenth-century America (or, perhaps, in twentieth-century Moscow). Meigs (MR: the designer)...adored Corinthian columns...[t]hus there are soaring Corinthian columns inside the Pension Building, seventy-five feet high, larger than...[any] that exist anywhere else in the world, including Corinth."

The quote is from The Wages of War, describing the post-war scenarios for soliders throughout America's history, divided up by ordeal. They cite the cost of the building at $866,614.04, which, according to AIER's cost-of-living calculator, comes to over $18,000,000 in today's funds. (Well, that's from 1913 dollars to now, I do know the value of the dollar didn't change a whole lot from 1880 to 1913, gold standards tend to do that.)

The website for the Pension Building is here, check out the inside of this place, and look at this picture for a minute...then notice the people in it.

The Least Pleasant Jobs: Military Edition

"Unmanned systems cost much less and offer greater loiter times than their manned counterparts, making them ideal for many of today's tasks," Gates told Air War College graduates last month.Of course the government is having a hard time getting these drones in place because of the various bureaucracies, which is what the story is really about.

"It flies higher. It flies faster. It carries more of a weapons load," said Lt. Gen. Norman Seip, commander of the 12th Air Force at Davis-Monthan Air Force Base, Arizona. "They're flying long, they are flying hard and they are making a big impact."

"After 27 years of experience as an intelligence professional, I had seen many agents place themselves in harm's way to collect information in some of the world's most dangerous and inaccessible environments," Gates said in his Air War College address. He welcomed the UAVs as a "far less risky and far more versatile means of gathering data."

Infinite Time Horizon and Guinness Beer

Arthur Guinness started brewing ales initially in Leixlip, then at the St. James's Gate Brewery, Dublin, Ireland from 1759. He signed a 9,000 year lease at £45 per annum for the unused brewery.Why 9,000 years? Why not 9 million? Weird. I bet £45 was a rip off for several years, but I don't know of an inflation calculator that goes that far back. Beer being one of the most important products in history, the industry has many different econ lessons for us.

Best T-Shirt Slogan

YouTube MySpace and I'll Google your YahooHat-tip to Amanda Bukrim

Thursday, May 22, 2008

Credit card charges

As my cashless journey presses onwards, I got to thinking: Why don't companies pass along the extra charge for using a credit card to customers? It can't be insignificant; most places have a threshold for charging purchases. Is it illegal vis a vis price discrimination? It's not price discrimination if the cost of providing the good is more; it's no different than charging more for certain pizza toppings. Would bad customer mojo set in? You've got a chance to pay less-- I don't think people would get terribly upset at that.

As my cashless journey presses onwards, I got to thinking: Why don't companies pass along the extra charge for using a credit card to customers? It can't be insignificant; most places have a threshold for charging purchases. Is it illegal vis a vis price discrimination? It's not price discrimination if the cost of providing the good is more; it's no different than charging more for certain pizza toppings. Would bad customer mojo set in? You've got a chance to pay less-- I don't think people would get terribly upset at that.Or, maybe they do pass it along in the form of higher prices for everyone.

Justin noted that it's an issue of incidence if they did apply it; I'm wavering back and forth. It's not a uniform tax on all goods sold, but the issue of who would bear the additional cost would, in theory, be applicable in an incidence framework. (I happen to think we live in a fuzzy, non-LNS world where many people wouldn't bat an eye at paying twenty cents more to use a credit card, but Walras thinks otherwise.) Would companies be imposing upon themselves some deadweight loss? Still not sure how I feel about this side of the story.

For those keeping track at home, the Great Cash Free Challenge hit a small bump in the road today: the first of many anticipated parking tickets. Though there was no amount on the ticket anywhere, I searched front and back numerous times. Perhaps it was a parking warning?

What Inference Can Be Drawn From Amazon Book Reviews?

For academically oriented books, if there are less than 5 reviews and they are all good, I discount them heavily. They are probably his friends or colleagues. If there are less than 5 reviews and they are all bad, unless I get the impression the reviewers are misguided based on their criticisms, I move on to the next book. Less than 5 reviews and none good? Couldn't they even get their friends or colleagues to give it a favorable review?

Please chime in on any methods you use.

Economic Naturalist: Uniform Edition

Why did Arby's charge me for the uniform, while Pizza Hut did not?

Arby's paid a higher wage, but they were not exactly the same type of food service so it is hard to determine if that means anything. Let's rule out "worker exploitation" because it is ridiculous, it was a competitive labor market and I could have gone other places, I went to Arby's because the wage was higher, I quit shortly thereafter because it was a disgusting place to work (at that particular franchise store, I still ate other Arby's).

My guess is that Arby's had (has?) higher turnover, so they use the uniform cost to discourage workers who do not expect to work long enough to recoup the cost of the uniform in higher wages. It would not be a useful deterrent afterwards as it would be a sunk cost, but it may have helped with the self-selection. Thoughts?

Wednesday, May 21, 2008

Assorted thoughts

- Since I've seemed to become a Jeopardy! commenter, the last two nights have witnessed an impressive display by a graduate student who, prior to Final Jeopardy, has had $42,000+ and $30,000+, respectively. I recommend tuning in; she is as aggressive of a Daily Double better that the show has seen in a while. In her first night, she had a chance to beat the Jeopardy high score, set by (who else?) Ken Jennings at a robust $75,000, but neglected her chance at Cliff Claven fame.

- I wrote last week about the problems the NBA has with unexciting teams seeming to have the most success in recent seasons; San Antonio and Detroit are the usual examples. Both teams are in the conference finals, and I'd imagine that David Stern shudders at the thought of the lower seeded Spurs and/or Pistons winning another series. I think Detroit has a very fair chance at winning against Boston and San Antonio a puncher's chance against Los Angeles; don't expect tonight's Game 1 of the latter to be indicative of the entire series, the Spurs didn't have a nice trip to L.A.

How Could He Possibly Know This?

"Normal supply and demand says prices should be around $55 to $60 a barrel," said Sen. Patrick Leahy, D-Vt., chairman of the committee. "Prices should not skyrocket like this in a properly functioning, competitive market."How could Senator Leahy possibly know what the price should be? Supply and demand is based on the individual subjective decisions of billions of people across the world. He can't know, it is impossible, he made it up out of thin air or paid someone to make it up for him. If "normal" supply and demand did "say" prices should be $55 to $60 then that's is what it would be purely out of the greedy self-interest of oil companies. However, gas stations are not running out of gas nor are they left holding huge stockpiles of unsold gas, suggesting we are close to equilibrium given the institutional constraints. I have posted evidence on the supply and demand that says that the price is responding to it before, but even still nobody has enough information (including oil executives) to know precisely what the price should be, and much of the oil pumped occurs in parts of the world without markets (Venezuela, Iran, etc.). Nonetheless, it seems they are competitive based on their profit margin's:

| BP | 7.66% |

| Exxon Mobil | 10.82% |

| Total S.A. | 9.63% |

| Chevron | 8.44% |

| ConcoPhillips | 6.75% |

| Eni SpA (E) | 11.39% |

| Repsol YPF SA | 6.12% |

6-11% for a risky business like oil (yes it is risky, natural disasters+congress=high risk).

Extra Innings, Part Deux

So I set out to prove what I'd put forth in the initial posting. Here's what I got:

- The best result is that teams are less likely to play an extra inning game if they have a game the next day. This holds true with home and visiting teams, as well as if they are playing the same team or a different team. In other words, teams are most likely to play an extra inning game if they do not have a game the next day.

- The number of pitchers used in a game is not a function of whether the team has a game the next day or not. Well, it is, but it's positive, but that's against the theory put forth. It's the same for visiting and home teams, as well as whether they play the same opponent or a different one the following day. Perhaps teams would rather use a large number of relievers in short roles than a few in long roles?

- Nothing comes from analyzing the length of extra inning games; models alternate between positive and negative, and all are insignificant. One could argue that this lends a bit of credence to my extra-innings-are-perpetual-short-run-scenarios argument. If they weren't, teams would want to reduce this number as much as possible. Or, maybe extra inning games really just don't have that much of an impact on teams the following day. I'm a bit hesitant to accept that, though.

Thanks to Frank for the data! If anyone has any spare data lying around, by all means, send it along...

Tuesday, May 20, 2008

Macro Problems

- Inflation is the devaluation of money, not increases in the prices of goods and services. Prices may rise for anything that shifts the demand curve right and the supply curve left. However, we spend a lot of time then teaching about the Consumer Price Index, which measures the price of goods and services because it is testable in multiple choice form.

- The source of a nation's wealth is its ability to produce goods and services. We measure that production in goods and services and call it GDP (GNP). For convenience we measure that production in dollars, but money nor gold is wealth. However, to write tests we make students figure out how to calculate GDP and it comes out looking like imports leave us poorer.

- Fiscal Keynesian Economics in its principles textbook form is dead, and the monetary side is still much debated. This doesn't stop us from devoting a chapter to fiscal stimulus logic in class. Leave it out, or else make it a chapter on economic folly.

Now I've got a motiviation!

Shouldn't all checks be different sizes too, based on value? If you got a bigger rebate check from Uncle Sam, shouldn't it vary by amount according to this logic?

Dana, tell me this isn't true.

The Great Cash Free Challenge

I think I can take the over, and with quite a bit to spare. I had a test run in New York this weekend and devised the following ground rules. Any objections, please let me know (soon):

- Obviously, no purchases of any kind with cash. Cash equivalent purchases, i.e. debit cards directly linked to bank accounts, are fine as they do not use the actual, physical cash. (I don't buy things like this, so that's not too big of an issue one way or the other.)

- Covering an entire tab for two or more and being reimbursed in cash is allowed. Paying someone for your portion of a tab in cash is not allowed.

- Should you find yourself in a scenario where a cash purchase is unavoidable, allowing another to cover the purchase in return for a corresponding non-cash purchase is, while following the letter of the law, not in the spirit of the game in my opinion. Activities as such should be avoided at all costs; for example, eating at a cash only restaurant with the intention of avoiding the bill in return for picking up the next tab is completely and wholly unethical. However, eating at credit card allowed restaurants and alternating tabs is completely allowed. As a rule of thumb, if you were partaking in the activity by yourself and cash could be feasibly avoided, then you are on the right path.

I'm heading to Montreal this coming weekend, and that could make things interesting. Eating, drinking and general activities shouldn't be too much of a problem. I'm most worried about airport activities; specifically, small purchases at or around boarding time and transportation to and from the airport. I think I can effectively self-regulate myself by never acquiring any Canadian currency. I do like foreign coinage though; it will be an interesting challenge to get Canadian coins without spending any cash.

By the way, 95.5 hours from today at noon is Saturday at 11:30am. I should be in the air to Montreal at that point.

Iraq Oil Production

I was wondering to myself what Iraq's oil production has been like lately in the face of rising prices. We would expect from the law of supply for it to increase, ceteris paribus. However, no reasonable person would suggest that ceteris paribus would hold here. Clearly from the above graph, which is in million bbl/d, they have not returned to pre-"Operation Freedom" levels yet. It is hard to know what their true production potential is because they are at war a minimum of 10 of the 27 years of data (1980-1988 with Iran, 1991 with the U.N., and 2003 - when and if you consider Operation Freedom to be over).

Cigarette Taxes and Happiness

TPS stalwart Thomas Johnson sent forth this bit on smoking, it gives a nice outline of a number of interesting paths of analysis when trying to explain smoking in a rational choice framework. It tries to get at the larger question of: Are smokers happy with higher cigarette taxes? In categorizing smokers, one possibility is that smokers are completely rational, know the costs and benefits of smoking, and move forward accordingly. You'd never guess it, but it's two Chicago economists with that theory! Another possibility is that people are helpless of smoking, paying any price to get their fix. Yet another possibility is that smokers know the long term costs but prefer the short term benefits. I like the first at face value-- millions of smokers can not all be categorically irrational. The second is absurd, and the third is an intertemporal explanation that deserves consideration-- after all, smokers have been shown to "irrationally" purchase only single packs of cigarettes when cartons would be much more cost feasible. There are definitely issues of multiple time periods involved in smoking.

Sadly, the author of the article turns to happiness surveys to try to get at the overall issue of whether rising cigarette prices lead to more happiness. I skimmed through the paper cited in the article-- it's pdf-linked there-- and they get at the issue by comparing the effect of higher cigarette taxes on high propensity to smoke groups versus the effect on low propensity to smoke groups, and conclude that higher taxes make the smoking groups better off. Well, it's been my experience that those who don't smoke get particular pleasure out of discouraging others to smoke-- higher taxes would certainly fall into that range. And I don't think those people are going to be distributed across the population in any significantly biased manner-- if anything, those that feel like this probably deal with smokers the most, so the distribution may well follow that of the smokers themselves. I'm not sure the study can avoid this possibility. Nonetheless, in happiness research, you're ultimately stuck comparing the happiness gained to happiness lost, and now Arrow is getting really upset.

I'm trying to come up with a good analogy for happiness surveys...I'll post it when it comes to me.

Big Empty Country II

I say "generous" because golf courses, cemeteries, and rural roads are considered "built-up" by the Census.

Data here.

Monday, May 19, 2008

The U.S.: One Big Empty Country

Jeffery Sachs can relax.

Cause Bitching is Free

Quick VoteAre you thinking of trading your car for a vehicle with better mpg?

Yes 45% 53605 No 55% 64623 Total Votes: 118228

I bet those 64k+ still bitch. I'm getting a scooter in the spring.

Ponderings on the Latest Forecast

- There were 52 forecasters surveyed, so it must be that 29 of the 52 agreed with this rather vague sentence about recession (55.7% rounds up to 56%).

- Intrade has responded, but is not yet as pessimistic as economists, as it is trading around 39.

- The survey date was April 17-May 1. The BEA released higher than expected numbers on April 30th, causing the Intrade shares to drop considerably that day. This would not be reflected well in the survey unless they were surveyed disproportionately on May 1. Even if they were, it is unlikely forecasters would have been able to include it in their model in such a short amount of time.

- Forecasters are the appropriate group to survey, better than the general economics population, but they have their own incentives via clients. Some have a incentive to be more optimistic, some more pessimistic, and since this is not a written or admitted bias I don't know how it weighs into the survey.

- Has someone changed the definition of "recession" on me? I understand it to be 2 consecutive quarters of negative growth. The survey estimates 1.4% of economic growth this year, sluggish but not a recession. The advance estimate for the first quarter is 0.6%. How do we have 2 negative quarters, 0.6%, and then average 1.4% on the year? Big about-face quarters of growth do not appear in professional forecasts, it is too risky for the forecaster.

- They discuss the Fed manipulation of the federal funds rate to help spur growth. Coincidentally, Meltzer is the guest on EconTalk this week discussing what the Fed is really doing.

- There is considerable discussion of how much of the tax rebates will be spent and when as well as the implications for economic growth. First of all, they were spent when the President and Congress made it clear they would be passed. Secondly, why debate whether the tax rebate will work on the logic it is supposed to when the logic itself is flawed. Assuming gravity is not a constraint, can a golf ball be hit farther if it has dimples or if it is smooth? Don't bother answering because it is functionally pointless, just like debating the tax rebates effect on the economy.

Sunday, May 18, 2008

On Season and Mid-Season Finales

The SciFi Channel has long drew my disdain for their ridiculous tinkering of the weeknight line-up. The Stargate shows are by far my favorite, but SciFi makes it hard to follow with "mid-season" cliff-hangers, followed by a few months off before they return to regular programming. By the time you get into the full swing of the show, it ends for several months. I don't have a link, but I have read their reason to be an effort to keep new episodes running year-round. Which to me, seems like staggering the season start of different shows would do the trick.

What is the economic or business model that explains this behavior?

Gas Savings Myths

Before you buy a device that's supposed to make your car more fuel-efficient or pour in an allegedly gas-saving additive, ask yourself this: Don't you think oil and car companies aren't doing everything they can to beat their competitors?

If BP (BP) could add something to its gasoline that made cars go farther on a gallon, cars would be lining up at the company's pumps. Sure, people would burn their fuel-saving BP gas more slowly, but then they'd drive right past rivals' gas stations to come back to BP for more. BP stations could even charge more for their gas and still sell tons of the stuff.

So if there really was an additive that made gas burn up more slowly, it wouldn't be sold over the Internet one bottle at a time.

Likewise, car companies are already spending big bucks to increase fuel mileage. If General Motors could make its cars go significantly farther on a gallon simply by putting a device into the fuel line, don't think for a second it wouldn't be doing that. GM's car sales would go through the roof.

.....

There's no question air-conditioning makes extra work for the engine, increasing fuel use. But car air conditioners are much more efficient today than they used to be. In around-town driving, using the A/C will drop fuel economy by about a mile a gallon.

.....

Modern engine technology comes to the rescue again. When sensors detect regular instead of premium fuel, the system automatically adjusts spark plug timing.

.....

Maintaining your car is important, but a clean air filter isn't going to save you any gas. Modern engines have computer sensors that automatically adjust the fuel-air mixture as an increasingly clogged air filter chokes off the engine's air supply.

Also, much of the research seems to have come from Consumer Reports.

Friday, May 16, 2008

Questions I've Been Pondering (with Matt)...Immigration

I think this would induce a massive push for economic and political reform around the world. Government power to exploit is derived from the immobility of its citizens. If the bridge club wants to impose an income tax on you, you can just quit the bridge club. If the federal government passes an income tax, it's comparatively harder for you to leave, especially if there no other countries accepting immigrants. (Hat Tip to Buchanan's Club Theory.)

Adopting this policy, I think there would be enormous pressure on other governments around the world to become "more like the U.S." with respect to political and economic freedoms in order to persuade the most skilled and beneficial citizens from leaving them for the U.S. This would be the most true for South and Central America, who have some existing institutions that can adopt change. Even if this did not happen and America just ended up with a much higher immigration rate, we would experience massive income growth as the number of brains in the economy increased. It probably would stimulate some favorable (though unpopular) institutional changes within the United States as well.

I think Matt didn't entirely agree, but I'll leave it to him to post in the comments. I anticipate some interesting comments on this one.

Question I've been pondering recently...mo' money mo' problems edition

Sorry for all of the questions lately...I'll return next week with real actual substance. If you're pining for something, here's this week's column on federal spending.

But I got to thinking...what would you rather live in: A completely cash-free society (credit cards and the like), or a cash-only society (bill and coinage only)? The world we live in now is increasing moving towards a cash-free society-- or at least away from cash-only-- and I, for one, think this is a great convenience. If it were cash-only, going to the ATM to re-up your carrying cash amount would be a pretty frequent occurrence and probably the biggest annoyance, not to mention internet sales would be more of a drag, and paying cash for a car or house might be difficult. I'd choose the former.

Is it feasible to live cash-less? I think so. Toll roads might be tough. Otherwise, I think I could credit card my way through life. When I get back from New York this weekend, I think I'm going to see how many days in a row I can go without paying for anything using cash. Small meals may be the biggest challenge, but most fast food places and small restaurants do take credit cards. I'm fine parking downtown so long as I'm in the garage and there for longer than 6 hours (no coins in meters, $3.00 is the minimum credit card charge).

I'm curious to see how long this can last. Rob, can you price me an over/under?

Thursday, May 15, 2008

Should We Lower the Speed Limit?

Gain $3.22, Lose $11.43 if gas prices don't change from that. In fact, gas prices would have to fall by $1.31 from the reduced demand to break-even.

That $1.31 reduction in price is unlikely. It is hard to reduce prices over the long-run by reducing demand in a competitive market (yes, oil and gas is competitive at every point in the production process). The main driver of lower prices is lower costs, which usually requires greater investment, which needs a high pay-off as a reward.

Questions I've been pondering (with Justin) recently ...benevolent dictator edition

Back in the day (and still somewhat today?), economics assumed that public officials were nothing short of heroic: the unfailing perfectness of all possible information at once and the benevolence of a saint. The problem is, no one makes decisions with perfect information, and holding public office doesn't stop you from being self-interested. Markets 1, Karl Marx 0.

But let's stay in the past. What would be the best example in history of a benevolent dictator? My history knowledge is decidedly weak, but I'll put my best guess in the comments. Justin had a good one as well, though I can't remember the exact name-- I'll leave that up to him.

If he's still reading the blog, I'd love to see what William Bernstein has to stay about this. I'm getting through the book, slowly but surely...

The Cost of Dollar Gas? Sleeping in Your Car

Drawing inference from a single observation then....if the next president pushes congress for a price control, many of us with higher time values (i.e. who have families and/or jobs) will end up buying our gas from high school students on the black market.

In other oil news, the election gimmick of not filling the strategic reserve. I'm not necessarily opposed to our not filling it, because I don't know how much we already have there, but it is clearly just politics. If "strategic emergency reserves" are important enough to have, shouldn't we save them for an actual emergency?

Wednesday, May 14, 2008

File This Under: Language is Important

I believe consumers systematically exaggerate the importance of gas prices to their budgets.I agree that it is clever by Chrysler to use this promotion, but for the reason of the Winner's Curse I posted before rather than a systematic bias. Are consumers systematically overstate fuel costs in their budgets? I doubt it, but I know of no literature directly on fuel costs and systematic bias showing one way or the other. Do consumers systematically overestimate how much fuel will cost them in the future? Since I haven't seen firms mass marketing oil futures to the general public, I doubt it. Do consumers systematically exaggerate the importance of gas prices to their budgets? I certainly think so, especially when talking with friends and journalists.

Side Note 1: In the contract period for $2.99 gas, I assign a prior probability of 5% that gas prices will fall in real terms. Over a longer horizon, I assign that prior to be 100%. The faster prices rise over the short-run, the shorter that longer horizon will have to be.

Side Note 2: My post on $2.99 gas drew me a comparison to Ricardo, and a quotation along side Levitt. By far the most successful post I have had.

Steady-State NBA Equilibrium?

It's interesting to compare across professional sports the viewing enjoyment of the each sport's successful teams by general public . The reason this comes to mind is that I'm repeatedly reminded by radio host after radio host of the potential sleepwalk of an NBA Finals should the San Antonio Spurs end up squaring off against the Detroit Pistons. What's interesting to me is that these two franchises are probably the Western and Eastern Conferences' most successful franchises over the last decade, yet they play probably the most viewer-unfriendly style of basketball. Doesn't this have to be a pretty large concern for the powers that be in the NBA?

The usual answer that comes from this line of reasoning is that the true fans of basketball will enjoy style of play offered by the Spurs and Pistons. Well, that may be, but in terms of generating viewership-- and depending what Justin wants to divulge, he's got some interesting comments about the NBA and its operating goals-- what matters are the marginal viewers. Short of going back to four corners basketball, diehard fans are going to watch anyway. It's those fans deciding between watching a NBA playoff game and a NHL playoff game, or American Idol, that matter-- and these viewers are being pushed away.

I guess the larger question is: Should anything be done? It could just be that we're in a short-term scenario where the most unappealing teams are the most successful. The Bulls were largely enjoyed in the 90s, as were the Lakers and Celtics in the 80s. Maybe it's a small market/large market perception issue? It could also be that success breeds contempt; if I remember correctly, both the Spurs and Pistons were well received when they began to have large-scale success. Rules have been changed over the last few years to nudge the game towards a more up-tempo, viewer friendly version, but not enough to bounce the best teams from the perch.

I personally am not a huge professional basketball fan, and I think one of the worst things that happened to the NBA in the recent past was Golden State missing the playoffs this year. I'm curious to see how this plays out in the near future. I have a feeling it's just a short term lull...but pressure will mount if exciting teams don't begin to have large scale success.

Tuesday, May 13, 2008

File This Under: Not That Profitable

| BP | 7.66% |

| Exxon Mobil | 10.82% |

| Total S.A. | 9.63% |

| Chevron | 8.44% |

| ConcoPhillips | 6.75% |

| Eni SpA (E) | 11.39% |

| Repsol YPF SA | 6.12% |

Compare that to the 3 or 4% they could make on an essentially risk-free 1 year Certificate of Deposit. Not particularly outlandish I would say. Other "evil" corporations are usually considered are those in the health insurance industry, their profit margins are:

| Aetna | 6.38% |

| Unitedhealth Group | 6.16% |

| Wellpoint | 5.11% |

Dead Economists

I'll be traveling to France this weekend to attend the European School on New Institutional Economics conference in Corsica. In preparation for my journey, I came across this excellent resource: Famous Economists' Grave Sites. I hope to see the grave sites of Marx, Molinari, Say, and maybe Smith.

I'll be traveling to France this weekend to attend the European School on New Institutional Economics conference in Corsica. In preparation for my journey, I came across this excellent resource: Famous Economists' Grave Sites. I hope to see the grave sites of Marx, Molinari, Say, and maybe Smith.

Questions: Professional Jury System

I also pose the following question: Given the choice between a year of being sequestered away from contact with the outside world or jail time, what would you choose? How much jail time would make you indifferent? I am thinking up to 1 month in a minimum security prison, provided there are no professional consequences to being a convict of this type.

My Thanks to the Wright State Department of Economics

Assessor Incentives and Property Assessment

Income Tax Responsiveness of The Rich: Evidence from MLB Free-Agent All-Stars

May I Sit Next to You, Senator Byrd? A Spatial Analysis of Spending Votes in the Senate

Revealed Preferences for Relative Status: Evidence from the Housing Market

Does Municipality and School District Congruence Matter?

Are Municipalities with NIMBYs undermined by School Finance Reform? Evidence from Nuclear Power Plants.

Do Property Growth Assessment Caps Encourage Eminent Domain Seizures for Private Development

Does the Housing Market Explain Why Income Matters in England and Canada?

Monday, May 12, 2008

Questions I've been pondering...

What animal to you think is responsible for the most human fatalities? We're going to eliminate amoeba/bacteria/virus, but if an animal is directly responsible for the contraction of said amoeba/bacteria/virus, then that animal gets the credit.

I expect the zoology contingent to chime in here.

My answer's in the comments...

Short Skirts Cause Impotency

Russian physiologist Leonid Kitaev-Smyk has stated that most male diseases are caused by women who adhere to provocative clothes and behaviour. As a result, the Western civilization gradually turns into the society of sexually unsatisfied men and eventually unsuccessful and physically unhealthy men, the scientist considers."Correlation," not causation. I put "correlation" in quotations because I doubt this really exists in this case as well.

Hat Tip: Pavel Yakovlev

Sunday, May 11, 2008

A couple of Sunday thoughts

- The post office is raising rates again tomorrow, monopoly-granted first-class mail will inch up a penny to 42 cents, as well as a host of other modifications. Available for purchase is a "forever stamp," which can be purchased at the current price of a first-class stamp but is always good for the value of a first class stamp. So, you can put one of these forever stamps that you bought last week on a letter ten years from now and you won't have to pay anything extra.

Why aren't these priced at a level above that of a first-class stamp? Am I missing something? People would pay a premium above this, especially since the Post Office announced they'll be increasing rates generally every year. Perhaps they overestimate the willingness to pay of the public...but then they'll just buy more of the fixed-value stamps, which generate the same revenue, and with the added future income of buying smaller stamp amounts so they can use them up after the rates increase again. Is there a downside anywhere to charging more? Perhaps stamps are like cigarettes and people irrationally buy them in smaller amounts.

It's effectively a financial instrument, isn't it? Does the SEC regulate this? If you bought a roll of these tomorrow at 42 cents, and the Postal Service kicked up the rates to 44 cents in a year, that's a tidy 4.7% return on your stamp investment. And short of the Postal Service lowering rates (monopoly on first-class letters-- probably not likely), you can't lose anything.

Bizarre.

- This last week and the next is College Championship week on Jeopardy!, I have to root for the Claremont Colleges and pull for the fellow from Harvey Mudd. I wrote a little while back about betting strategies, and I must say, I think I saw perhaps the single-worst bet in my Jeopardy! watching experience.

Tournaments are a little different than regular play. They last for two weeks, and the first week is the first round. The five individual winners advance along with the four highest dollar totals amongst the non-winners. One girl, I believe she was on Thursday night's show, had about $22,000 heading into Final Jeopardy. This was the high score for the individual game. Because she played on Thursday, she (presumably) has the knowledge advantage of what 6 of the 10 non-winners have earned. I'm 95% certain that she had out-earned the previous 6 non-winners. This means that she can bet nothing and advance to the next round. This can't be overstated. In the 5% chance that she hadn't out earned everyone, $22,000 does everything but guarantee you a shot in the next round. Instead of taking the certain spot in next week's semifinals, she sees the category...and bets every dollar she has. I was amazed at this. I'm still amazed at this. There's a reason that episode of Cheers is very well known. She ended up getting it right for the win, but...really? Betting all of your money there? In a tournament? In the first round?! The only time I could think of this being even remotely acceptable would be in the first half of the championship of a tournament.

Now, if you get to keep the money that you earn in every part of the tourney, then this might explain the strategy a bit (though still doesn't justify it, in my eyes). I'm also fairly certain that seeding plays little to no role-- you might get the chance to select the first question of your respective semifinal match if you were one of the best players of the previous week, but I'm not positive of that and even then that is of minuscule importance.

I think about Jeopardy a lot.

Economists: Out-of-Touch Pointed-Headed Academics

What don’t you people understand.

Normal American patients do not care about the inner-workings of the human body. They want to feel good all the time and have lots of energy. If someone can cure them with leeches, all the better.

Saturday, May 10, 2008

History Lies: American Democracy was Top-Down

This is a perplexing view considering the Founding Fathers never really embraced the idea of a complete direct democracy at the national level. There were various restrictions on who could vote and an electorate system that prevented anything resembling a direct democracy. On the other hand, the pioneer attitude that existed was not indulged in for the good of American society, but was rather the result of individual action. Entrepreneur's looking for resources, arable land, and other profitable opportunities often needed to not just discover these locations, but they needed to attract labor as well. Entrepreneurs of the day needed to not just develop resources, but develop communities to support life and they were in competition with each other to do this. They did this through many means most of which would be familiar to us - wages, benefits, property - but they also needed to provide institutions for these communities to exist under. It was hard, and often dangerous, to move through the frontier, and you needed a credible commitment that you and your children could flourish without fear that the original landowner would strip you of your property. What often emerged from this competition was a system of direct democracy that was similar corporate structures firms of the day held. Shareholders typically got one vote, regardless of how many shares they actually held, and local governments mimicked this type of structure.

If anything, the discussion should be that the Democracy was imperfectly copied from local municipalities to the State and Nation level. We would not have been a bunch of caveman monarchies were it not for the state and nation. To borrow from Alexander de Tocqueville (Democracy In America, 1835, vol. 1, ch. 2):

The political existence of the majority of the nations of Europe commenced in the superior ranks of society and was gradually and imperfectly communicated to the different members of the social body. In America, on the contrary, it may be said that the township was organized before the county, the county before the state, and the state before the union.For more on local governments, read the Homevoter Hypothesis.

Friday, May 09, 2008

Turns out most of America doesn't know about Ricardian Equivalence...

Just when I thought the broad range of Americans had a firm grasp on Ricardian equivalence...

...it just seems like they feel that the amount is not enough. Pity.

The Wikipedia entry above points out an interesting fact that I'd temporarily forgotten-- Ricardo proposed and rejected the idea. Should his name be attached to the concept then? Can I propose a whole host of ideas and reject them all, only to have my name attached upon others' future insight? Isn't this the risk-free way of having your name live on past your death?

I think I'm on to something here. (But I reject it fully.)

Would FEMA by Any Other Name Smell As Sweet?

"We off-loaded the food, and then the authorities refused us permission to take that food away.

"We were told we needed a special letter from the Minister of Social Welfare. We hand-delivered a request to him. The answer back was 'No, you can't have the food.'

"That food is now sitting on the tarmac doing no good."

Under U.N. rules, the organization must control and distribute its aid supplies.

What's worse than one FEMA-syle organization coordinating disaster relief? Two - Myanmar and the U.N. If only they had Wal-Mart.

Thursday, May 08, 2008

Get your 23-cent pizza!

When it comes to pizza, Cleveland and economics, Rob Holub is on the scene.

As a gesture of goodwill to the Cleveland Cavaliers fans, Papa John's is offering 23 cent pizzas as a peace offering for a D.C. area manager printing up shirts making fun of LeBron James. Do you think people like 23-cent pizza? Judge for yourself here and here.

Some quick facts:

- There are 1,200 people in line at one location; another estimate is at 1,700.

- Papa John's stopped taking phone orders long ago.

- It took 3 hours and 20 minutes for one person to get their 23-cent pizza.

- Due to the popularity of the event, traffic on some freeways has slowed to a crawl around exits near Papa John's locations.

The obvious question here-- and it's the same when gas stations go on the cheap as a promotion-- is why do people wait in line for a giveaway when, considering the opportunity cost of doing so, it seems like a losing proposition? I think the only answer is that people really enjoying being part of a promotion. They get value out of the story; sure, I had to wait in line for 3 hours to get a cheap pizza, but how can I possibly value being able to tell my friends for the indefinite future? I don't believe it's entirely separate from betting longshots at the racetrack-- the story has value, and maybe because it's indeterminate exactly how valuable it is, you end up with individuals massively mis-pricing it.

I can't think this is a bad deal for Papa Johns; they seem to take a mild one-time financial hit (if at all-- could a plain pepperoni pizza cost them more than 23 cents?) for a big publicity boom. This is a very big company, too-- they just announced recently that they surpassed $1 billion in online orders alone. Most of the downside of this ordeal is shoveled onto the community-- congestion and a few instances of impatient customers requiring an increased police presence. Increasing private benefits through increased negative externalities? That's the plan of the day.

If the Cavs win the NBA title, I bet Papa John's might pull the same trick again.

Crackernomics

It's becoming more well-known that Monopoly isn't exactly the ideal grounds for teaching the fundamentals of economics-- viewing the world as zero-sum, prices increasing as supply increases, etc. In fact, our fourth post, by TPS de facto Emeritus David Skarbek, concerned the game.

Settlers of Catan is often cited as a preferred alternative to Monopoly, but loyal TPS followers Tom and Dana Johnson have sent along another: Crackernomics. Here's a piece about it, and here's another. In the words of one of the articles...

Crackernomics is a highly interactive, action-packed game teaches children economics, geography, international investment principles and basic entrepreneurial skills in a fun-filled environment.I'm curious about the action-packed aspect, but anything that gets kids thinking like economists from a young age is great by me.

Here's even more games from the manufacturer. Odds that Roman Ross grows up playing these games: Strong. Strong to very strong.